Bitcoin is currently in a consolidation phase after a strong multi-month uptrend that began in April. Following weeks of heightened volatility and selling pressure, BTC has managed to hold steady above critical support levels, keeping the broader bullish narrative alive. Some analysts argue that this resilience highlights the strength of Bitcoin’s current market structure and even suggest that a push beyond all-time highs could be on the horizon in the coming weeks.

Despite uncertainty and cautious sentiment, long-term holders and institutional flows continue to provide a foundation for Bitcoin’s price stability. While short-term corrections remain possible, the broader market remains optimistic that BTC is preparing for another leg higher.

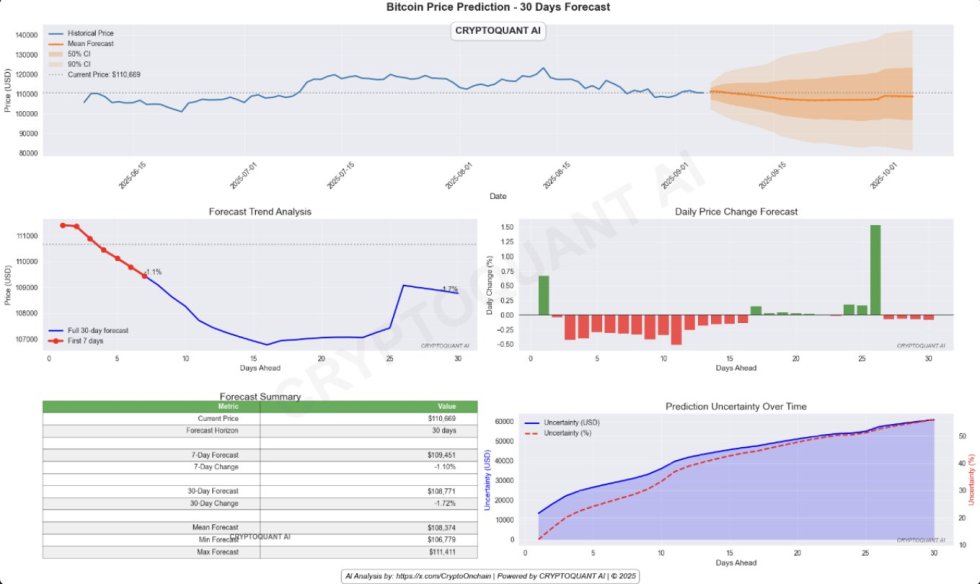

CryptoQuant analyst Crypto Onchain recently shared a Bitcoin TFT AI Forecast, which points to BTC trading in a mostly neutral range for the next month. According to the model, Bitcoin is likely to stay around current levels without a sharp breakout or collapse in the near term. This reinforces the idea that the market is digesting its recent gains before attempting another move.

Bitcoin AI Forecast Suggests Rising Uncertainty

According to the Temporal Fusion Transformer (TFT) AI Forecast, Bitcoin is expected to trade within a mostly neutral range in the coming weeks, though uncertainty is rising sharply. The model places Bitcoin’s current price at $110,669, projecting a 1.1% decline to $109,451 over the next seven days. Looking further ahead, the 30-day forecast anticipates a 1.72% decrease to $108,771, reinforcing the idea of consolidation rather than a clear bullish or bearish breakout.

The most important signal, however, is not the modest downside forecast, but the sharp opening of confidence intervals. Model uncertainty climbs above 50% by the end of the forecast period, signaling elevated risk and the potential for severe volatility. This uncertainty opens the door to multiple scenarios.

The main scenario, combining both the WaveNet and TFT models, suggests Bitcoin will hold within the $108,000–$120,000 channel, a range-bound movement likely to dominate the first three weeks of September. A surprise scenario, however, could emerge in the final week. If a strong catalyst or sudden sentiment shift occurs, the elevated uncertainty could translate into an explosive move—either a breakout to fresh highs or a sharp retrace.

While the market faces slight selling pressure short term, the last week of September may prove decisive, with volatility set to define Bitcoin’s next big move.

Testing Support Within Ongoing Consolidation

The 3-day Bitcoin chart shows BTC trading at $112,146, rebounding 1.77% after recent volatility. The price remains in a consolidation phase following the rejection from the all-time high near $124,500. Notably, Bitcoin has so far defended the $110,000 support zone, which has acted as a floor during recent pullbacks.

The moving averages highlight the structure: the 50-day SMA at $107,765 and the 100-day SMA at $100,647 provide strong medium-term support. Meanwhile, the 200-day SMA at $81,576 remains far below, reflecting Bitcoin’s broader bullish cycle despite short-term weakness. Holding above the 50-day average is key for confirming the resilience of this uptrend.

Immediate resistance lies at $115,000, a level Bitcoin failed to reclaim in its last attempts. A successful breakout above this region could open the path toward $120,000–123,000, where the ATH sits. Conversely, failure to maintain $110,000 could trigger further downside, potentially targeting the $107,000–105,000 range.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.