The Bitcoin price has slipped under $117,000 as on-chain data shows the network has observed one of its largest profit realization days of the year.

Bitcoin Long-Term Holders Did The Major Share Of Profit-Taking

In a new post on X, the on-chain analytics firm Glassnode has talked about the latest trend in the Bitcoin Realized Profit indicator for the short-term holders and long-term holders. The “Realized Profit” measures, as its name suggests, the total amount of profit that the BTC investors are realizing through their transactions.

The metric works by going through the transfer history of each coin being sold to see what price it was moved at prior to this. The difference between that previous price and the current selling price denote the amount of profit or loss involved in the sale.

Naturally, the sale realizes a gain if the difference is positive. The Realized Profit adds up this value involved in all transactions of the type occurring on the blockchain. Another indicator known as the Realized Loss keeps track of the sales of the opposite type.

In the context of the current discussion, the Realized Profit of two specific segments of the sector is of interest: short-term holders (STHs) and long-term holders (LTHs). Investors are divided into these groups based on the basis of holding time. More particularly, holders who have been carrying their coins for 155 days or less are put in the STHs and those who have made it past this threshold are considered LTHs.

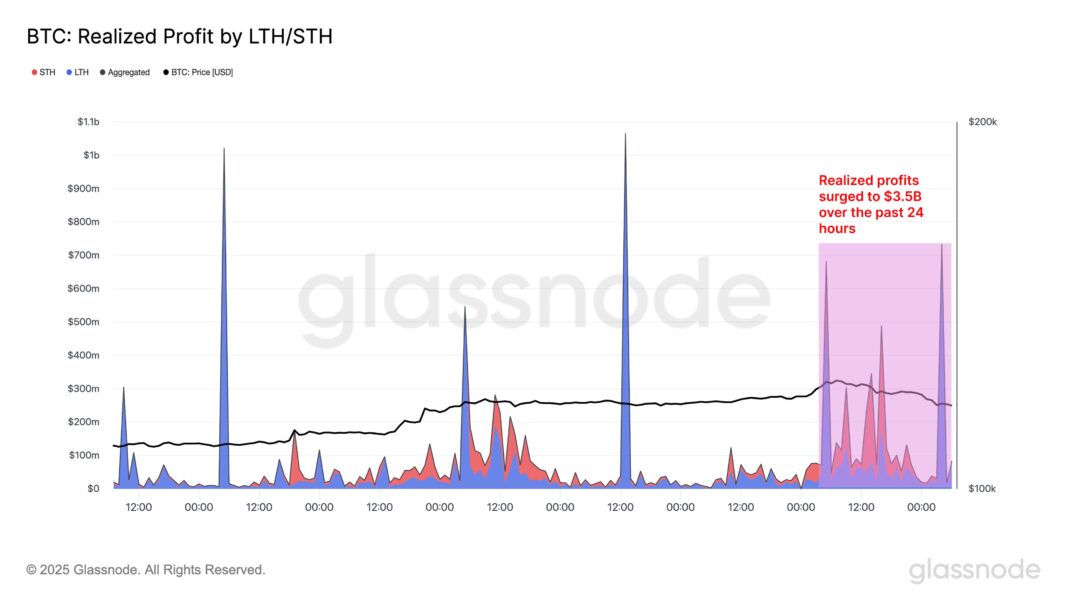

Below is the chart shared by Glassnode that shows the trend in the Realized Profit for the two sides of the Bitcoin market.

As displayed in the graph, the Bitcoin Realized Profit has seen spikes for both of these groups during the last 24 hours, implying investors across the market have harvested gains taking advantage of the rally to the new all-time high (ATH) above $123,000.

In total, the holders took profits equal to $3.5 billion inside this window, making the profit-taking event one of the largest for the year. Interestingly, the LTHs occupied for a higher share ($1.96 billion or 56%) of the profit realization than the STHs ($1.54 billion or 44%).

Generally, the longer an investor holds onto their coins, the less likely they become to sell them. As such, the LTHs with their relatively long holding time are considered to represent the resolute side of the market.

Despite their strong resolve, however, it seems the latest Bitcoin price surge provided a temptation strong enough for even these diamond hands to be swayed. The result of the selloff has so far appeared to be a price decline to levels below $117,000.

BTC Price

At the time of writing, Bitcoin is floating around $116,700, up over 7% in the last week.